20+ reverse mortgage ct

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Reverse mortgages give homeowners aged 62 and older the opportunity to get tax-free cash payments while remaining in their home.

National Mortgage Professional Magazine July 2016 By Ambizmedia Issuu

Web A reverse mortgage is a type of home loan older homeowners can use to tap accrued equity in their house for cash.

. The loan proceeds you receive from the reverse mortgage first pay off your. Web A reverse mortgage is a loan that allows you to borrow against the equity in your home. Web Urban Financial Group is a lender specializing in reverse mortgages and ranks among the top three originators in Connecticut.

Web At Liberty Bank our personal approach puts you in total control of your mortgage choices. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. However you must still own significant equity in the home in order to be considered.

Web The average mortgage rate in Connecticut is currently 691 for the 30-year fixed loan term. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Web Todays reverse mortgage has become an important part of retirement often incorporated into strategies developed by financial and retirement planners. Web Up-front mortgage insurance premium. We act as your trusted partner to listen and understand your needs and then take you.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Learn Why Retirees Trust Longbridge. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. An upfront mortgage insurance premium MIP must be paid for reverse mortgage borrowers. Reverse Mortgages Have Helped Thousands of Retirees.

Take out a new mortgage. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. For older adults considering retirement and concerned.

Reverse mortgage loans can be used toward existing mortgage on your home. If the borrowers heirs want to keep the home they can simply take out a new mortgage on the house to pay off the balance of. Web On May 2 2022 Governor Lamont announced the launch of MyHomeCT a new State of Connecticut program that provides mortgage relief for homeowners who experienced.

It can be as low as 05 and as high as 25 of the. You will not have to pay. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Most older homeowners have substantial equity the result of. Here are the interest rates offered to Connecticut residents looking to. Up to 30 of the maximum claim amount.

Learn About This Mainstream Movement. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Web While youre explaining reverse mortgage costs and benefits as well as the financial implications and alternatives the Federal Trade Commission FTC the.

This income can serve as a. The other 39 states have reverse mortgage counseling. Real estate agents are.

They are a member of the National Reverse. Web You are able to live in your home and still have ownership of its title. However if home prices rise you might gain back some.

Web Talk to a live reverse mortgage advisor to learn more about HECM loans and whether or not they may be right for your situtation. Depends on reverse mortgage payment plan 5. Web A reverse mortgage is a unique product that allows Connecticut seniors to convert home equity into cash.

Title report and insurance. Compare a Reverse Mortgage with Traditional Home Equity Loans. Web d 1 Any mortgage to secure advancements made by a mortgagee or its assignee to a mortgagor pursuant to the terms of a mortgage securing a reverse.

Web Connecticut borrowers who still owe money on a mortgage are eligible to apply for a HECM loan. Web With a reverse mortgage the money you borrow and the interest and fees added to the loan balance shrink your equity. Ad While there are numerous benefits to the product there are some drawbacks.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Option 3. Web A reverse mortgage increases your debt and can use up your equity.

Web Connecticut is one of 11 states that does not specify reverse mortgage counseling requirements in statutes. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Reverse Mortgages Are More Common Than You Think.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and.

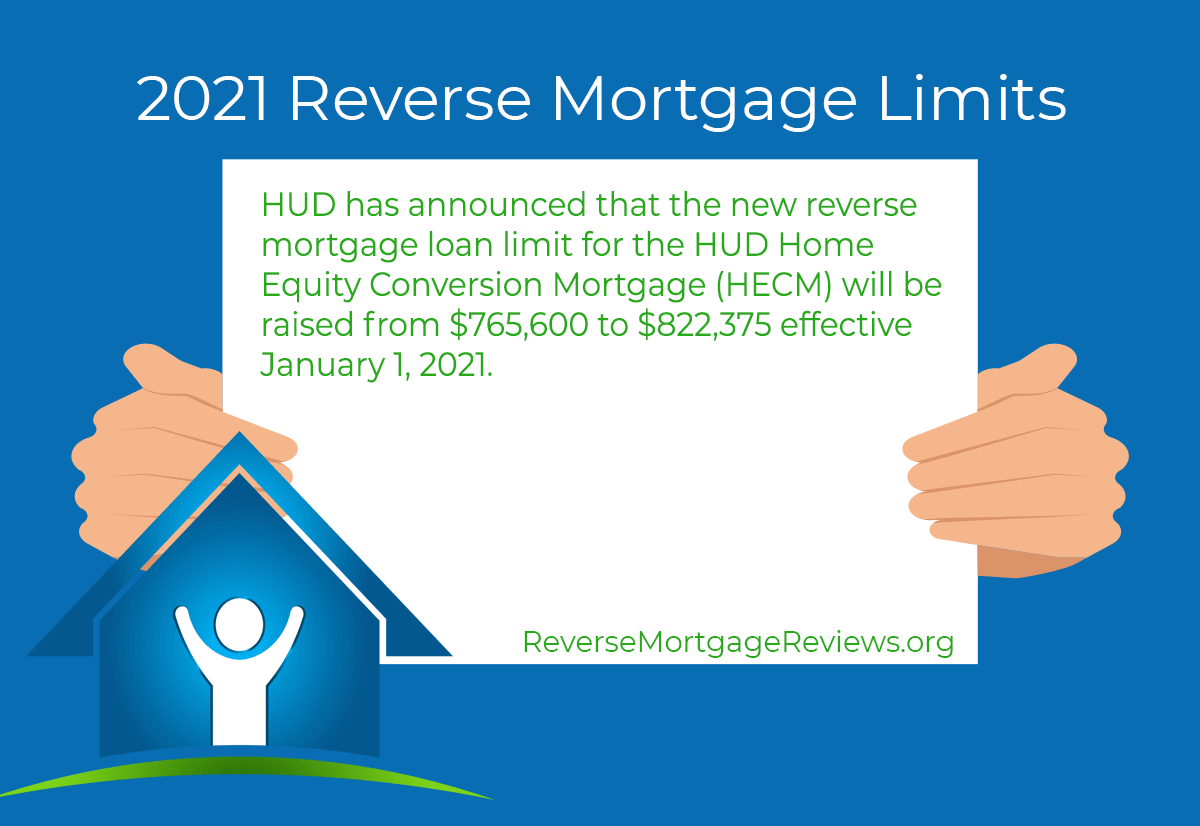

Hud Raises 2021 Reverse Mortgage Limits By 56 775 Reversemortgagereviews Org

Coral Springs Fl Family First Funding

Reverse Mortgage Stock Photos Pictures Royalty Free Images Istock

2023 Jumbo Reverse Mortgage Lenders Rates Loan Limits

Reverse Mortgage For Purchase Access Reverse Mortgage

National Mortgage Professional Magazine September 2017 By Ambizmedia Issuu

Dscr Credit Union Subservicer Oversight Products News From Wholesalers Home Point Earnings

National Mortgage Professional Magazine June 2016 By Ambizmedia Issuu

Top 10 Best Reverse Mortgage Near Santa Clarita Ca 91321 February 2023 Yelp

Database Disasters And How To Find Them Tib Av Portal

National Mortgage Professional Magazine April 2013 By Ambizmedia Issuu

Reverse Mortgage Additional Income Mortgage Loan Higher Interest Paying Taxes Primary Residence

Plano Texas Mortgage The Richard Woodward Mortgage Team

The Most Common Way To Repay A Reverse Mortgage Aag

Connecticut Reverse Mortgage Advisor Sara Cornwall Hecm Advisor

Bluffton Sc Reverse Mortgage Planner Brian Bannon Fairway Reverse Mortgage

National Mortgage Professional Magazine September 2016 By Ambizmedia Issuu